Millions lost without an exit plan…

[The following is an adaptation based on a true story. The names have been changed to protect the identities involved.]

“Mr. Yow Sang Yee was a successful businessman. He had joined his childhood friend, Mr. Tai Sek Sai, to start a factory manufacturing carpets. Mr. Tai had a 60% share of the business while he had the remaining 40%. Ever since they started, the business had grown by leaps and bounds. Annual profit was now in the region of RM4 million. Their accountant had indicated that the business should have a value in the range of RM10 to RM15 million.

Then tragedy struck. He was diagnosed with third stage cancer of the liver and his health deteriorated. He wrote a will to give his assets to his wife and children. He took comfort in the thought that the value of his share of the business alone was enough to take care of his family comfortably and see his kids through their tertiary education. He also believed that Mr.Tai will not short change him as they have been childhood friends.

After Mr. Yow’s departure, the wife wanted to dispose of his share but Mr. Tai turned her down because he was already controlling and running the company. Unfortunately for her, no outsider was willing to buy her shares and she had no choice but to plead with Mr. Tai to reconsider the purchase of the shares. He offered her a price of only RM1 million, rather than RM4 to RM6 million, which she had no choice but to accept it.”

The above story illustrates the dramatic drop in value from business disruption due to the loss of a co-owner or partner and sometimes even the downfall or closure of the business that could have been avoided.

A well-constructed plan is essential to protect the value of the business in the event there is a major disruption in the business due to a co-owner’s death, disability, retirement or serious major illness or any other event that jeopardizes the continuity of the business.

Ask yourself:

- If a co-owner dies today, can you work with his family to run the business?

- Will the co-owner’s family members know how to run the business with you?

- Can they work well with you?

- Would your beneficiaries be able to get a fair price?

- Do you have the funds to buy out the co-owner’s shares/interests from the family members when there is no pre-agreed price in a written agreement?

- Can the shares/interests you are purchasing be transferred quickly to you?

Problems Without Business Protection Plan

Often these are:

- A new partnership is created due to the inheritance of the shares/interest by inexperienced heirs. Chances are this new partnership may fail;

- There is no pre-agreed price for any sale to take place when the heirs decide to sell to the other co-owners. As a result, it may take years to settle a transaction price.

- Some of the unqualified heirs may insist to be directors of the company and be active in running the business. This may lead to serious disruptions and disputes within management.

- It is possible that the co-owners may decide to abandon the business and start their own due to disputes with the heirs. However, starting a fresh new business may take a lot of time and money.

- Loss of profits and uncertainty about the business future success.

After all your hard work in building your business, how can you protect against such problems?

The Solution –Business Value Protection Trust (UBiz):

Our UBiz is the solution to ensure that there is a smooth transition of the business to the other co-owner(s) and the value of your share of the business is protected upon the happening of an unfortunate event such as:

- Death

- Incapacity

- Ill health

- Retirement

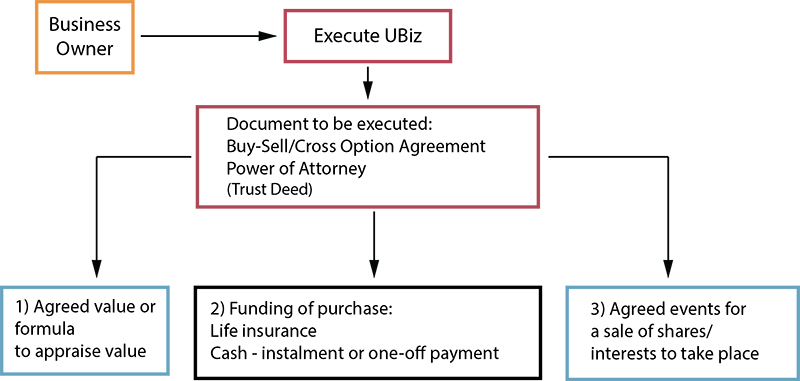

Our UBiz consists of:

- Buy-Sell or Cross Option Agreement: covering the terms of the sale and purchase including the agreed value or formula, events triggering a sale, funding and mode of payment.

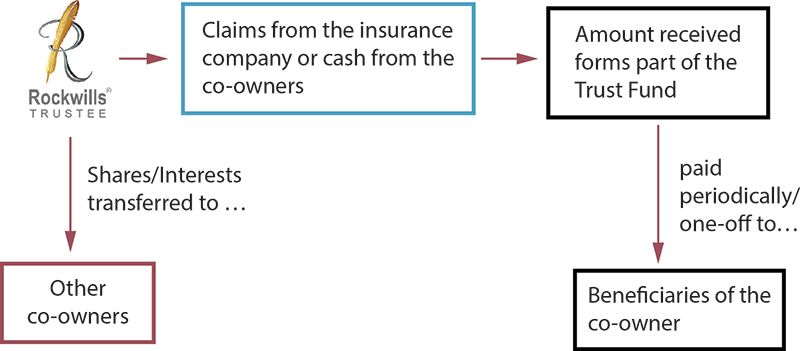

- Power of Attorney: authorizing us, Rockwills Trustee, to transfer the shares/interests to the other co-owner(s) upon the occurrence of the agreed events that trigger a sale.

- Trust Deed by the co-owners: instructions to Rockwills Trustee regarding the periodical distribution of the sale proceeds to prevent these being misspent by the beneficiaries.

- Life insurance policy: as the main funding mechanism to purchase the shares/interest of the outgoing co-owner.

How to Set-up

Advantages of UBiz

- Guarantees the sale of shares/interest at a full and fair value that was agreed by co-owners.

- Prevents inexperienced and unqualified heirs from being involved in the business or the selling of the deceased’s shares to outsiders.

- Smooth transfer of ownership to the co-owners is ensured by the Trustee.

- Using life insurance, the purchase of the shares/interest becomes very affordable, minimizing the need to use your savings for the purchase.

- Rockwills Trustee acts as the Trustee for UBiz protecting the interests of your beneficiaries and that of the co-owners.

- Shares/interests are easily converted.

Please contact us for a FREE estate planning consultation

Tel: 03-7877 9939

Email: info@rockwills.info