What is UDeclare?

UDeclare is a Declaration of Trust that is simple, flexible and powerful providing for your loved ones and securing their financial well-being. It is NOT subject to Grant of Probate or Letters of Administration. It is REVOCABLE and the contents can be changed anytime before Settlor’s death.

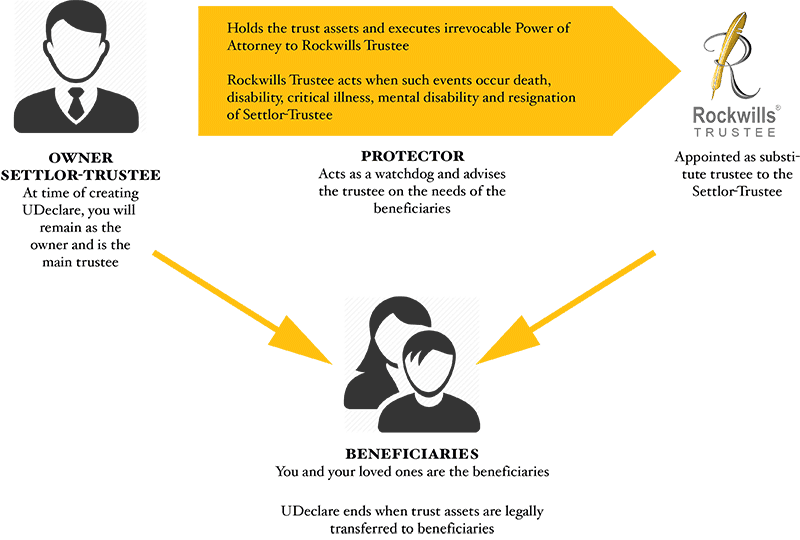

A Declaration of Trust is an estate planning tool where the owner of a assets (Settlor) will create a trust settlement by declaring that the assets that he owns is actually a trust assets and he plays the role as a Trustee and he is holding the assets for a another person who is named as a beneficiary.

Under UDeclare, a trust is set up by you (Settlor) as Trustee with Rockwills Trustee as your substitute Trustee. This prevents any delay in allowing your beneficiaries to enjoy the trust assets. You acting as Trustee retain control and ownership of the trust assets.

Under UDeclare, you need not transfer the assets yet until any of the following events that are determined by you occurs:

- Death

- Total Permanent Disability (TPD)

- Critical Illness

- Comatose

- Resignation as Trustee

- Missing* for a period to be stated in the trust

*UDeclare resolves the problem of lack of death certificate for distribution of assets

How to Set Up Declaration of Trust?

What Assets Can Be Used For UDeclare?

Any asset in West Malaysia, whether encumbered or not, such as your residential property, unit trust / mutual fund investments, shares of companies, moneys in your bank account(s), can be form part of UDeclare.

Benefits of UDeclare

During your lifetime, you can be one of the beneficiaries thus receiving income from the trust. So, in any emergencies, you will be able to withdraw your portion in UDeclare.

Just like a living trust, UDeclare prevents delays and provides for fast distribution to your beneficiaries in their time of need or it can be accumulated for a specified period.

When the Settlor is acting as the Trustee, there are no transfers to Rockwills Trustee so you will be able to save on certain fees such as stamp duty, legal fees and the trustee’s annual fee.

Your beneficiaries will also benefit from our independent position as we shall act impartially and fairly to all beneficiaries. This safeguards their individual interests in the trust.

With the appointment of a Protector as a watchdog and advisor to the Trustee, there is clear protection of your beneficiaries’ interest.

By appointing Rockwills Trustee as your substitute, you ensure that your instruction in the trust are carried out by a professional and experienced Trustee

Please contact us for a FREE estate planning consultation

Tel: 03-7877 9939

Email: info@rockwills.info