Protection – Our Natural Instinct

“Almost all animals protect their young from dangers. An interesting example is the Cichlid fish (one of which is the common Tilapia). Both the male and female take turns to fan their eggs with their fins from above so as to increase oxygen flow for better egg development and to prevent fungal spores from growing on them. They also eat the unfertilized eggs to prevent contamination for the healthy ones. After the young hatch, the parents continue to care for and protect them. When there is a threat from a predator, they will suck the young into their mouth until the danger is gone. Such wonderful devotion!”

As parents, you too would protect your children. For example, you may purchase insurance so that in case something happens to you while they are young, there will at least be cash to provide for their needs. If you have taken insurance, chances are, you may think that you have done enough in providing security to your loved ones by nominating them as your beneficiaries in your insurance policies. Think again.

Are your loved ones completely protected when you nominate them as beneficiaries in your insurance policies?

Is that actually enough? You may want to consider:-

- If your spouse is the sole beneficiary to your insurance policy, what happens to the insurance proceeds upon your spouse’s passing?

- If your young children are the beneficiaries, who should claim the insurance proceeds for them in the event both you and your spouse are unable to?

- Are your beneficiaries mature enough to handle large sums of money?

- Is there someone competent enough to assist the beneficiaries?

You can prevent these problems when you create a UProtect insurance trust with Rockwills Trustee Berhad.

Insurance Trust (UProtect)

Do you know that Trust is an extremely effective Estate Planning tool to protect your assets and to pass to your heirs efficiently whilst maintaining privacy? You can continue to have control on how the insurance proceeds are distributed even when you are no longer around.

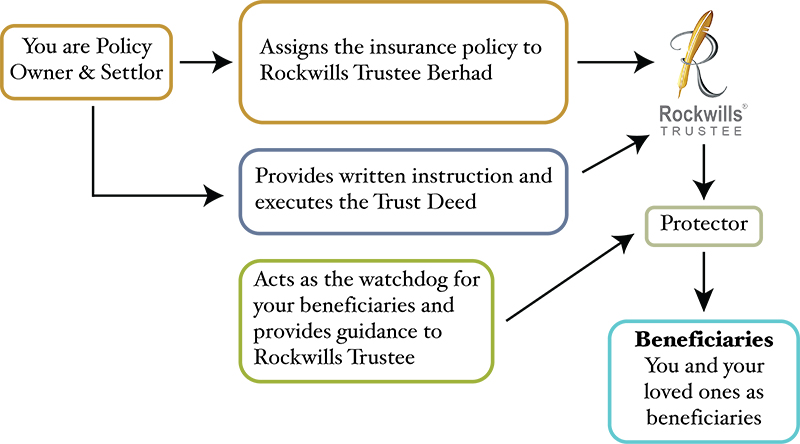

Structure of UProtect

With UProtect, your beneficiaries are completely protected when you execute a trust deed stating your instructions and transfer your insurance policy(s) to Rockwills Trustee by way of assignment or appointment as s.166 Trustee.

As your Trustee, we assure you that your insurance proceeds are:

Protected and readily available for immediate usage

– As the insurance is not part of your estate, there is no need to wait for the extraction of Grant of Probate or Letters of Administration.

Used to finance education needs, living and medical expenses of your beneficiaries

– Your loved ones will still enjoy life like how it is now even when you are no longer around.

– Should there be a claim for disability or major illness, you will be able to receive the insurance proceeds for your living and medical expenses.

Paid to your loved ones the way you choose

– You decide who shall receive from the Trust as well as how and when they can receive the monies.

– You can also include substitute beneficiaries to replace those who are unable to receive.

Please contact us for a FREE estate planning consultation

Tel: 03-7877 9939

Email: info@rockwills.info